Navigating Property Ownership in Walker County: A Comprehensive Guide to the Tax Map

Related Articles: Navigating Property Ownership in Walker County: A Comprehensive Guide to the Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Property Ownership in Walker County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Ownership in Walker County: A Comprehensive Guide to the Tax Map

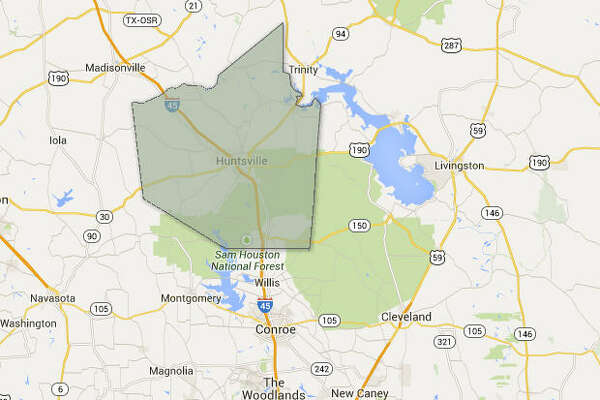

Walker County, like many other counties across the United States, utilizes a tax map as an essential tool for managing and understanding property ownership. This map, often referred to as a "plat map," provides a visual representation of land parcels within the county, along with crucial information about each property. Understanding the Walker County tax map empowers individuals, businesses, and government agencies alike to navigate property-related matters efficiently and effectively.

Decoding the Walker County Tax Map: A Visual Representation of Ownership

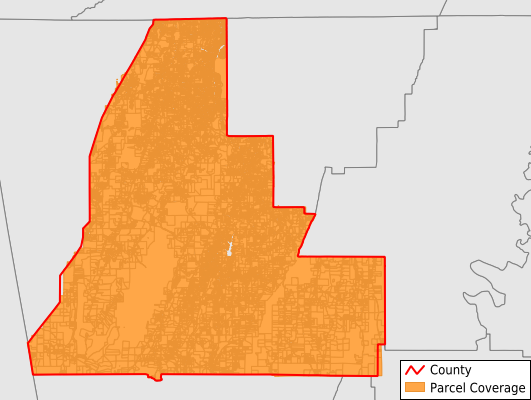

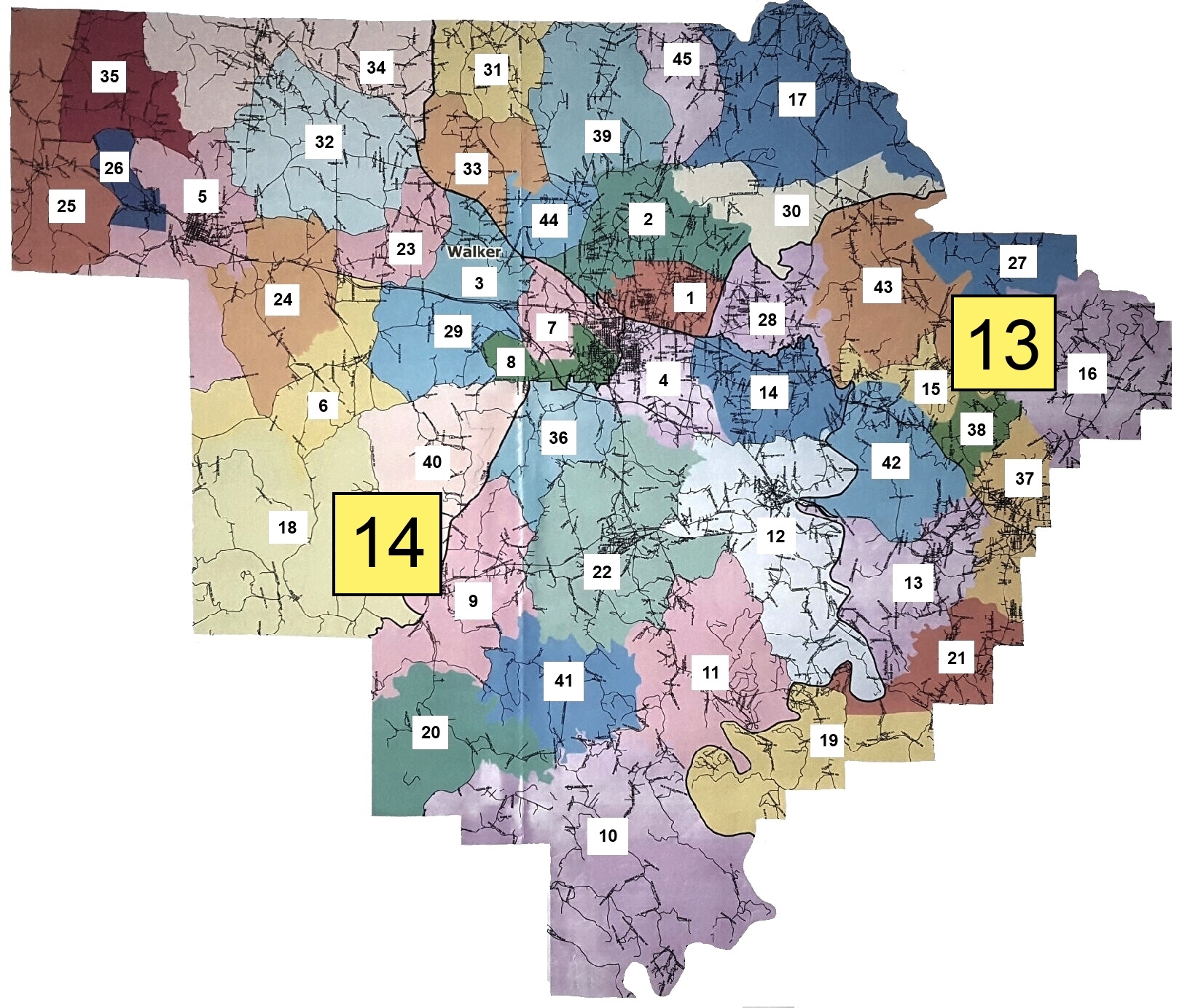

The Walker County tax map is a detailed, scaled diagram that serves as a visual index of all properties within the county. Each parcel of land is assigned a unique identification number, which acts as a key to accessing a wealth of information about the property. This information typically includes:

- Property Boundaries: The map clearly delineates the boundaries of each property, showing its exact location and size.

- Ownership Information: The map lists the current owner’s name and address, providing a direct link to property ownership.

- Property Classification: Each property is categorized based on its usage, such as residential, commercial, agricultural, or industrial.

- Tax Assessment: The map displays the assessed value of each property, which is used to calculate property taxes.

- Zoning Regulations: The map may also indicate zoning restrictions that apply to each property, outlining permitted land uses and building regulations.

The Importance of the Walker County Tax Map: A Foundation for Informed Decisions

The Walker County tax map serves as a foundation for a wide range of property-related activities, including:

- Property Transactions: Buyers and sellers rely on the tax map to verify property boundaries, identify any encumbrances, and gain a clear understanding of the property’s characteristics.

- Property Tax Assessment: The tax map provides the basis for calculating property taxes, ensuring equitable distribution of tax burdens.

- Land Development and Planning: Developers and planners use the tax map to identify available land, assess suitability for different projects, and ensure compliance with zoning regulations.

- Public Services: Emergency responders, utility companies, and other public service providers utilize the tax map to locate properties efficiently and respond effectively to calls for service.

- Legal Disputes: In cases of boundary disputes or other property-related legal matters, the tax map serves as a valuable reference point, providing evidence of ownership and property characteristics.

Accessing the Walker County Tax Map: A User-Friendly Resource

The Walker County tax map is typically accessible through various channels, providing users with convenient options to access the information they need:

- Online Platforms: Many counties have digitized their tax maps, making them readily available online through dedicated websites or mapping portals.

- County Assessor’s Office: The Walker County Assessor’s Office is a primary source for accessing the tax map, offering physical copies, digital downloads, and assistance with map interpretation.

- Real Estate Professionals: Real estate agents and brokers often have access to the tax map and can assist clients in interpreting the information.

FAQs Regarding the Walker County Tax Map

Q: How do I find the tax map for a specific property in Walker County?

A: The Walker County Assessor’s Office is the primary source for accessing the tax map. You can visit their office in person, contact them via phone or email, or explore their website for online map resources.

Q: Can I use the tax map to determine the value of a property?

A: The tax map provides the assessed value of a property, which is used for tax purposes. However, the market value of a property can vary based on factors such as location, condition, and market demand. It is recommended to consult with a real estate professional for a more accurate estimate of market value.

Q: Is the tax map updated regularly?

A: The Walker County Assessor’s Office maintains and updates the tax map on a regular basis to reflect changes in property ownership, boundaries, and other relevant information.

Q: What if I find an error or discrepancy in the tax map?

A: If you identify any inaccuracies in the tax map, it is important to report them to the Walker County Assessor’s Office. They will investigate the issue and make necessary corrections to ensure the accuracy of the map.

Tips for Utilizing the Walker County Tax Map Effectively

- Familiarize Yourself with the Map Legend: Understand the symbols and abbreviations used on the map to interpret the information accurately.

- Use a Scale: Pay attention to the scale of the map to accurately measure distances and property sizes.

- Verify Information: Always confirm information obtained from the tax map with other sources, such as property deeds or official records.

- Seek Professional Guidance: If you are unsure about interpreting the map or need assistance with property-related matters, consult with a real estate professional or legal expert.

Conclusion: The Walker County Tax Map – A Vital Resource for Property Management

The Walker County tax map serves as a vital resource for individuals, businesses, and government agencies alike. It provides a comprehensive overview of property ownership within the county, facilitating informed decision-making in various property-related matters. By understanding the map’s contents and utilizing it effectively, users can navigate property ownership with greater clarity, accuracy, and efficiency.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Ownership in Walker County: A Comprehensive Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!