Navigating Property Values: Understanding the Cook County Assessor Map

Related Articles: Navigating Property Values: Understanding the Cook County Assessor Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Property Values: Understanding the Cook County Assessor Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Values: Understanding the Cook County Assessor Map

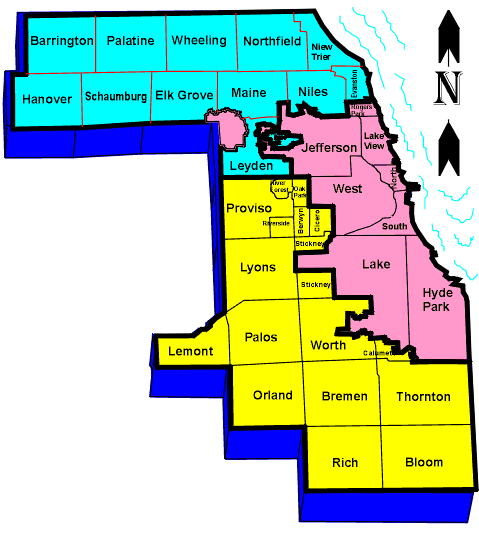

The Cook County Assessor’s Office plays a pivotal role in determining property values within the county, impacting everything from property taxes to real estate transactions. A key tool in this process is the Cook County Assessor Map, an online resource that provides a visual representation of property boundaries, ownership information, and assessed values. This article delves into the intricacies of the map, exploring its features, benefits, and its essential role in understanding property valuations within Cook County.

Decoding the Map: A Visual Guide to Property Information

The Cook County Assessor Map is a user-friendly interface that allows individuals to search for specific properties and access a wealth of information. Its primary functions include:

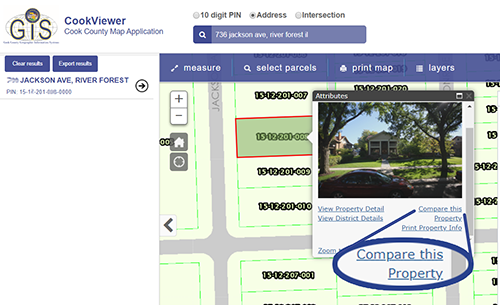

- Property Identification: The map facilitates easy property identification using various search methods. Users can enter an address, property index number (PIN), or even use the interactive map to pinpoint a specific location.

- Visual Boundaries: The map displays clear property boundaries, visually separating individual parcels of land. This helps users understand the extent of their property and identify any potential boundary disputes.

- Ownership Details: The map provides information on property ownership, including the owner’s name and contact details. This information can be particularly valuable for individuals researching properties for potential purchase or investment.

- Assessed Values: The map displays the assessed value of each property, representing the value assigned by the Cook County Assessor’s Office for tax purposes. This value is crucial for calculating property taxes and understanding the financial implications of owning a property.

- Property Characteristics: The map often includes additional information about the property, such as its size, building type, and year built. This data provides a comprehensive overview of the property’s characteristics, aiding in property comparisons and valuations.

Beyond the Map: Understanding the Assessment Process

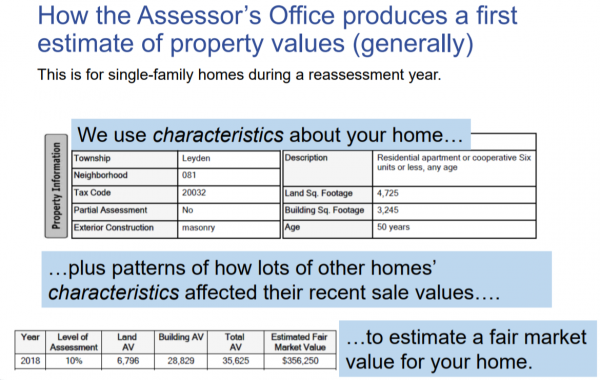

The Cook County Assessor’s Office utilizes a complex process to determine the assessed value of properties. This process takes into account several factors, including:

- Market Value: The Assessor’s Office strives to establish the fair market value of each property, reflecting the price it would likely fetch in a competitive market.

- Property Characteristics: The physical characteristics of a property, such as its size, age, and condition, play a significant role in determining its value.

- Comparable Sales: The Assessor’s Office analyzes recent sales of similar properties in the area to establish a benchmark for valuation.

- Economic Factors: Economic factors, such as local market trends and property tax rates, can influence property values.

The Importance of the Cook County Assessor Map

The Cook County Assessor Map serves as a vital resource for various stakeholders:

- Property Owners: The map empowers property owners to understand the assessed value of their property and potential tax implications. This knowledge can help them make informed decisions about their property, including potential renovations or appeals of assessed values.

- Real Estate Professionals: Real estate agents and brokers rely on the map to access property information, facilitating property comparisons and market analysis. This information aids in pricing properties accurately and understanding market trends.

- Investors: Investors use the map to identify potential investment opportunities, researching property values, ownership details, and market conditions. The map provides a valuable tool for making informed investment decisions.

- Government Agencies: Government agencies, including the Cook County Treasurer’s Office, utilize the map to manage property tax collection and ensure equitable tax distribution.

Navigating the Map: FAQs and Tips

Frequently Asked Questions

-

How do I access the Cook County Assessor Map?

The Cook County Assessor Map is accessible online through the official website of the Cook County Assessor’s Office. -

What if I find an error on the map?

If you discover an error on the map, contact the Cook County Assessor’s Office to report the discrepancy. They will investigate the issue and make necessary corrections. -

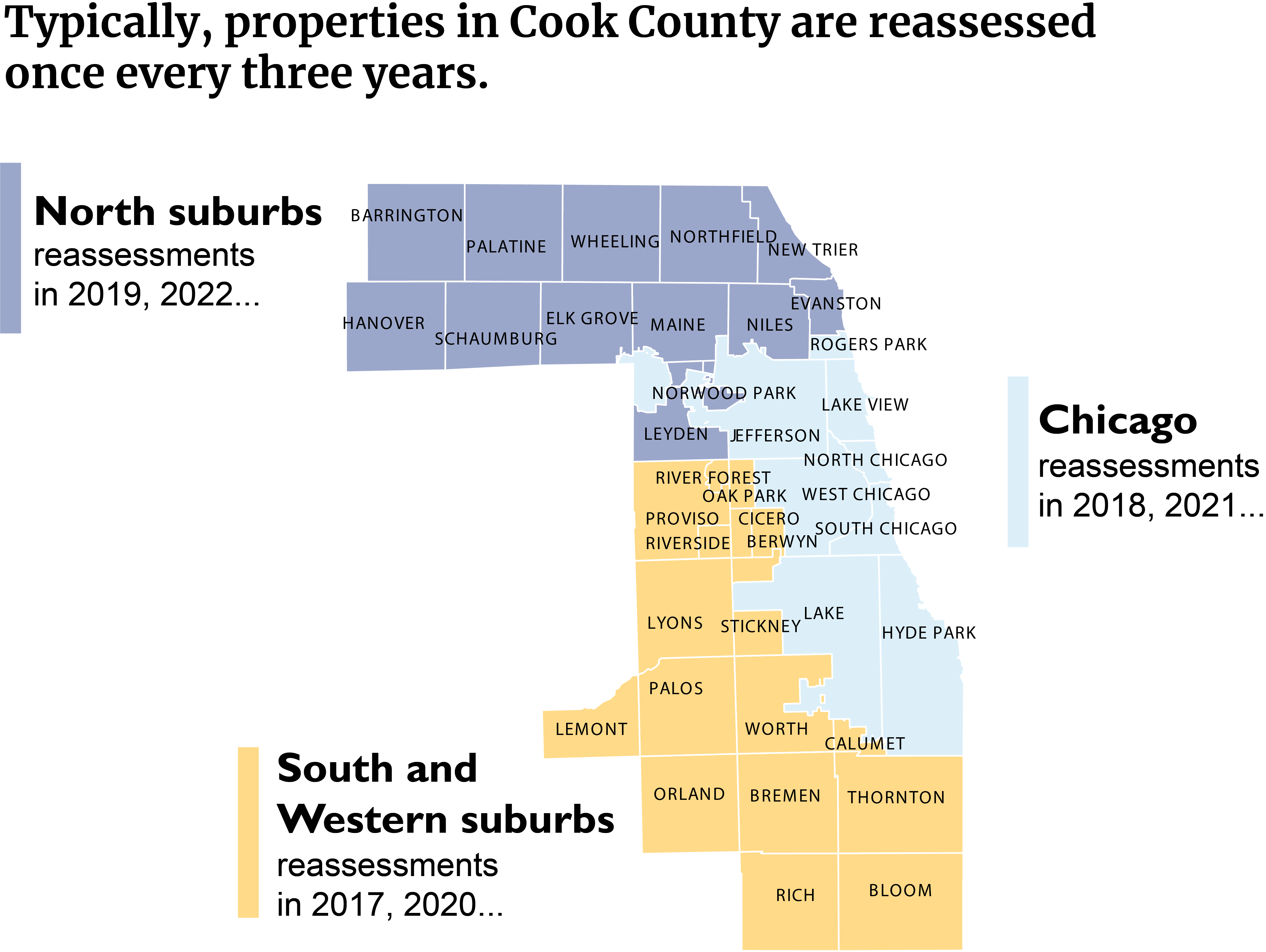

How often is the map updated?

The Cook County Assessor Map is updated regularly to reflect changes in property values and ownership information. The frequency of updates may vary depending on the specific data being updated. -

Can I use the map to challenge my property assessment?

The map provides valuable information for understanding property values and potential grounds for challenging an assessment. However, it is advisable to consult with a qualified professional for guidance on filing a property tax appeal. -

What if I cannot find my property on the map?

If your property is not visible on the map, contact the Cook County Assessor’s Office for assistance in locating the property. They may have additional tools or resources to help identify your property.

Tips for Using the Map

- Familiarize yourself with the map’s features: Explore the various search options and tools available on the map to optimize your search.

- Use the zoom function: Zoom in and out to view specific properties and their surrounding areas in greater detail.

- Utilize the layer options: The map may offer various layers, such as aerial imagery or parcel boundaries, which can provide additional context and information.

- Save your searches: Save your searches for future reference, allowing for easy access to specific properties or areas of interest.

- Contact the Assessor’s Office for assistance: If you encounter any difficulties using the map or have specific questions, reach out to the Cook County Assessor’s Office for support.

Conclusion

The Cook County Assessor Map serves as a vital tool for understanding property values and navigating the complexities of the real estate market within Cook County. By providing easy access to property information, the map empowers individuals, businesses, and government agencies to make informed decisions regarding property ownership, investment, and tax management. As technology continues to evolve, the Assessor’s Office will likely enhance the map’s capabilities, further streamlining access to crucial property data and promoting transparency in the valuation process.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Values: Understanding the Cook County Assessor Map. We appreciate your attention to our article. See you in our next article!