Unlocking the Secrets of Richland County’s Property Landscape: A Comprehensive Guide to the GIS Tax Map

Related Articles: Unlocking the Secrets of Richland County’s Property Landscape: A Comprehensive Guide to the GIS Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the Secrets of Richland County’s Property Landscape: A Comprehensive Guide to the GIS Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Richland County’s Property Landscape: A Comprehensive Guide to the GIS Tax Map

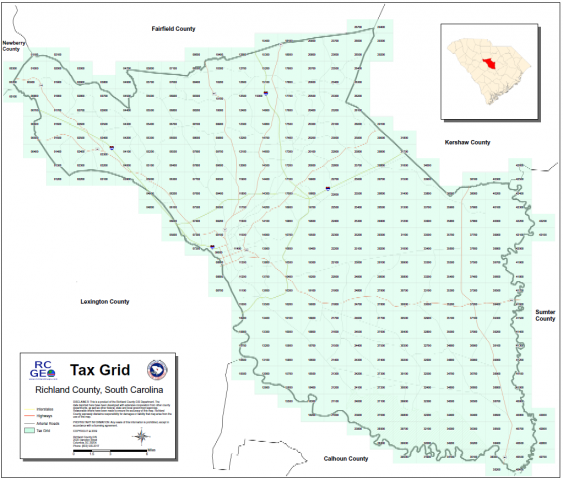

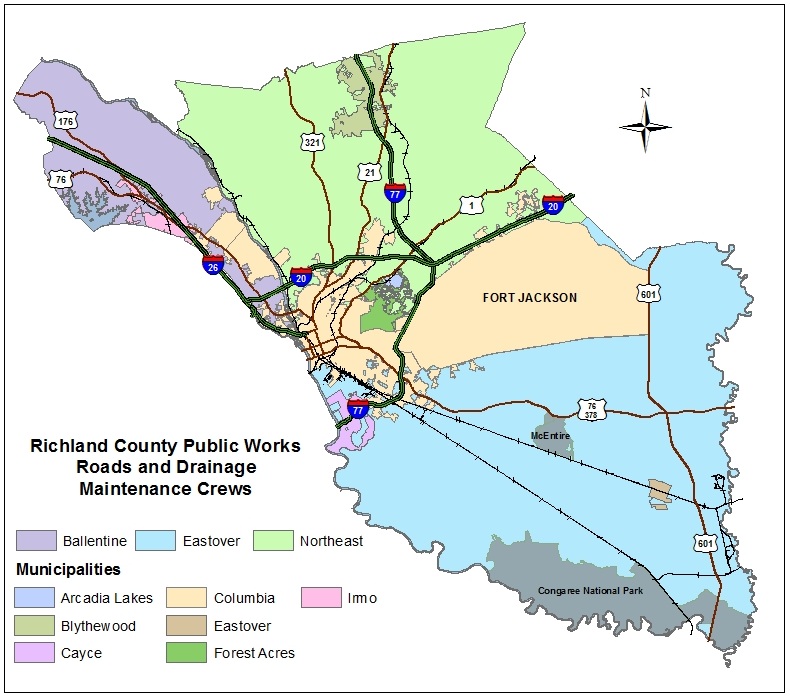

Richland County, South Carolina, like many other counties across the nation, relies on a Geographic Information System (GIS) tax map to manage its property records. This digital map serves as a vital tool for various stakeholders, including residents, businesses, government agencies, and real estate professionals, offering a wealth of information about properties within the county.

Understanding the Basics of the GIS Tax Map

The Richland County GIS tax map is a sophisticated digital representation of the county’s physical landscape, incorporating detailed information about each property parcel. This information is organized and accessible through a user-friendly interface, allowing individuals to navigate the map and extract valuable data about specific properties.

Key Features of the Richland County GIS Tax Map

The GIS tax map provides a comprehensive overview of properties within the county, encompassing the following key features:

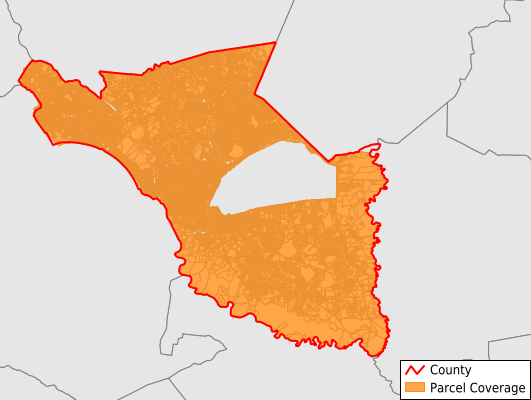

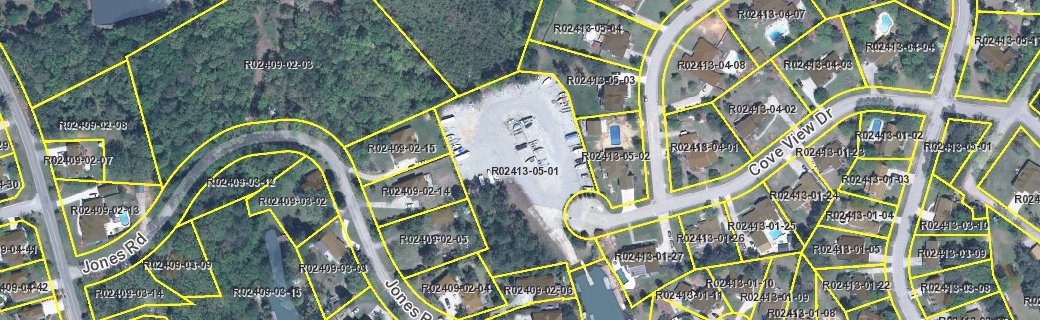

- Parcel Boundaries: Precisely defined boundaries of each individual property parcel, allowing for accurate identification and measurement.

- Property Ownership: Detailed information about the legal owner of each property, including name, address, and contact details.

- Property Address: The official address assigned to each property, ensuring clear identification and location.

- Property Type: Classification of property types, including residential, commercial, industrial, agricultural, and vacant land.

- Tax Assessment: The assessed value of each property, which forms the basis for property tax calculations.

- Property Features: Information about key property features, such as the number of bedrooms and bathrooms (for residential properties), square footage, and presence of utilities.

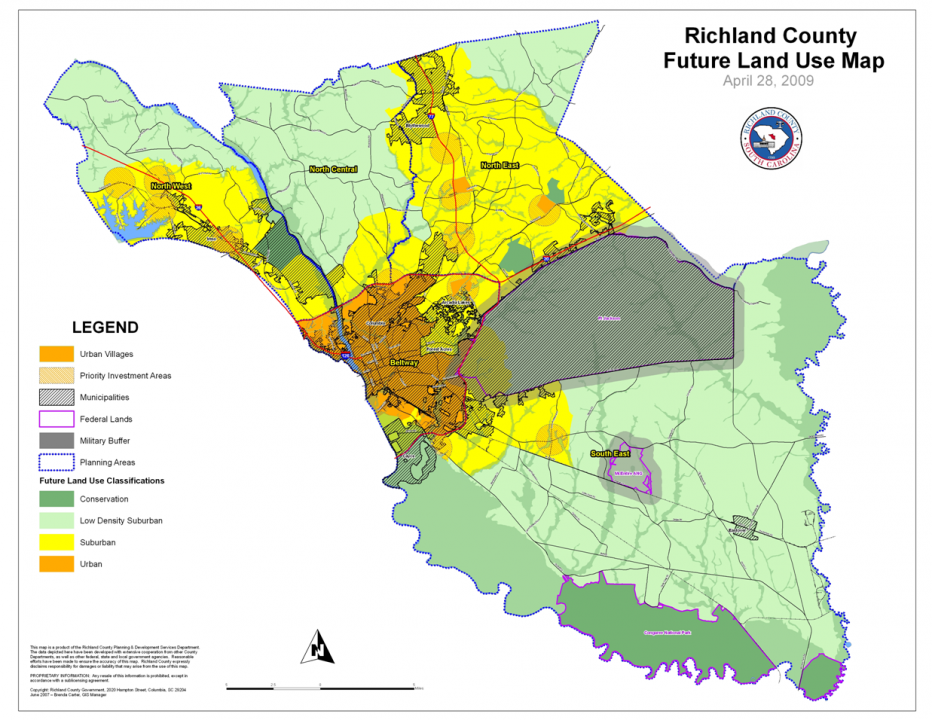

- Zoning Information: Details about the zoning regulations applicable to each property, guiding development and land use.

- Property History: Records of past transactions, including sales history, ownership changes, and property value fluctuations.

- Aerial Imagery: High-resolution aerial photographs of the county, providing a visual representation of the property landscape.

- Map Layers: Customizable map layers allowing users to filter and display specific data points based on their needs.

Benefits of Utilizing the Richland County GIS Tax Map

The Richland County GIS tax map serves as an invaluable resource for various individuals and organizations, offering a range of benefits:

For Residents:

- Property Information: Residents can easily access detailed information about their own property, including its boundaries, assessed value, and tax history.

- Neighborhood Exploration: The map allows residents to explore their neighborhood, identify nearby amenities, and understand the surrounding property landscape.

- Property Value Assessment: Residents can compare their property value to neighboring properties, providing insights into market trends and potential home values.

- Property Tax Information: Access to tax assessment information helps residents understand their property tax obligations and potentially identify any discrepancies.

For Businesses:

- Site Selection: Businesses can utilize the map to identify potential locations for new businesses or expansions, considering factors like zoning, property value, and proximity to amenities.

- Market Analysis: Businesses can analyze property trends and demographics within specific areas, informing marketing strategies and investment decisions.

- Property Management: Businesses with multiple properties can efficiently manage their portfolio, tracking property values, tax obligations, and maintenance needs.

For Real Estate Professionals:

- Property Valuation: Real estate agents and appraisers can leverage the map to determine accurate property values, supporting appraisals and sales negotiations.

- Market Research: The map provides valuable data for market research, helping agents understand property trends, identify hot areas, and assess investment opportunities.

- Client Communication: Agents can utilize the map to effectively communicate property information to clients, providing a clear visual representation of properties and their surrounding environment.

For Government Agencies:

- Property Tax Administration: The map facilitates efficient property tax administration, enabling accurate assessment and collection of property taxes.

- Land Use Planning: The GIS tax map supports land use planning, providing data for zoning decisions, infrastructure development, and environmental protection.

- Emergency Response: The map can be used to identify property locations and access points, aiding in emergency response efforts during natural disasters or other emergencies.

Accessing the Richland County GIS Tax Map

The Richland County GIS tax map is readily accessible online, through the Richland County Assessor’s website. Users can access the map through a user-friendly interface, allowing them to search for specific properties, navigate the map, and extract relevant data.

FAQs about the Richland County GIS Tax Map

Q: How do I access the Richland County GIS Tax Map?

A: The Richland County GIS tax map is available online through the Richland County Assessor’s website. You can typically access the map by navigating to the "Property Records" or "GIS Map" section of the website.

Q: Do I need to create an account to access the map?

A: Most Richland County GIS tax maps are publicly accessible without requiring an account. However, some features or advanced search functions might require registration.

Q: What information can I find on the map?

A: The map provides a wealth of information about properties in Richland County, including parcel boundaries, property ownership, address, property type, tax assessment, property features, zoning information, and property history.

Q: Can I download data from the map?

A: Many GIS tax maps allow users to download data in various formats, such as PDF, CSV, or shapefiles. The specific download options may vary depending on the platform.

Q: How up-to-date is the information on the map?

A: The information on the GIS tax map is generally updated regularly, but the frequency of updates may vary depending on the specific data points. It’s advisable to check the website for information about data update schedules.

Q: Can I use the map to determine property values?

A: The map provides tax assessment values, which can be used as a starting point for estimating property values. However, it’s important to note that tax assessments are not always an accurate reflection of market values.

Q: Is the map available as a mobile app?

A: Some counties offer mobile apps that provide access to their GIS tax maps. You can check the Richland County Assessor’s website or app store for information about mobile app availability.

Tips for Utilizing the Richland County GIS Tax Map Effectively

- Familiarize yourself with the map interface: Take some time to explore the map’s features and functionalities to understand how to navigate and search for specific properties.

- Use the search function effectively: Utilize the map’s search function to find properties by address, owner name, or parcel number.

- Explore the map layers: Experiment with different map layers to filter and display specific data points relevant to your needs.

- Download data for further analysis: Download data from the map in various formats to conduct in-depth analysis or create custom reports.

- Check for data updates: Stay informed about data update schedules to ensure you’re using the most current information.

Conclusion

The Richland County GIS tax map is a powerful tool that provides valuable insights into the county’s property landscape. By leveraging this resource, residents, businesses, real estate professionals, and government agencies can access critical information, make informed decisions, and streamline operations. As technology continues to advance, the GIS tax map will continue to evolve, offering even more sophisticated features and functionalities to support various stakeholders within Richland County.

![]()

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Richland County’s Property Landscape: A Comprehensive Guide to the GIS Tax Map. We thank you for taking the time to read this article. See you in our next article!